A Gift in Your Will or Trust

Route 66 Association Hall of Fame & Museum, Pontiac, Illinois

With as little as one sentence, you can make a gift in

your will or trust that significantly impacts the efforts of the National Trust

to preserve history. Whether you choose to give a set amount or a percentage of

your estate, your support ensures we have the resources to save America’s

historic places.

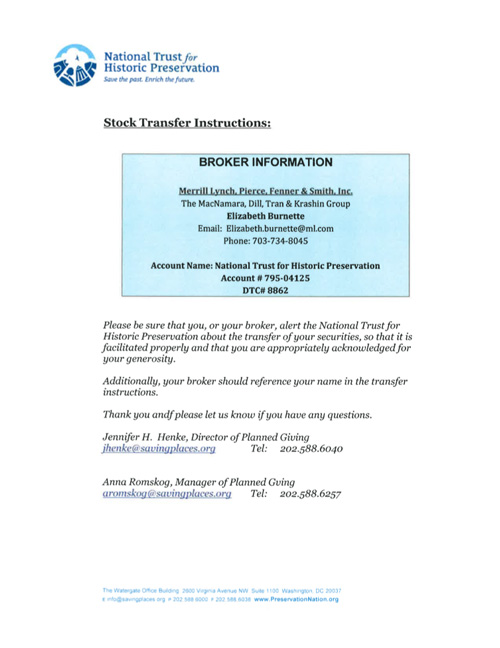

Sample language